Strategic Partnerships for Strength: Bagley Risk Management

Strategic Partnerships for Strength: Bagley Risk Management

Blog Article

Just How Livestock Danger Security (LRP) Insurance Coverage Can Secure Your Animals Investment

Livestock Threat Security (LRP) insurance policy stands as a reputable guard versus the uncertain nature of the market, supplying a critical strategy to guarding your properties. By diving right into the intricacies of LRP insurance and its multifaceted benefits, animals producers can fortify their investments with a layer of safety and security that goes beyond market changes.

Understanding Livestock Threat Protection (LRP) Insurance

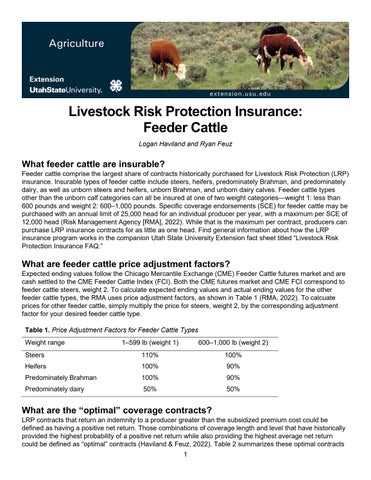

Recognizing Animals Risk Defense (LRP) Insurance policy is essential for animals producers looking to minimize monetary risks related to rate changes. LRP is a government subsidized insurance item designed to protect manufacturers against a decline in market rates. By offering coverage for market cost declines, LRP assists producers secure in a flooring cost for their livestock, making certain a minimum degree of income no matter of market changes.

One key element of LRP is its flexibility, enabling manufacturers to personalize protection levels and plan lengths to fit their specific requirements. Producers can pick the number of head, weight array, coverage cost, and insurance coverage duration that align with their manufacturing objectives and run the risk of resistance. Understanding these customizable choices is essential for manufacturers to effectively manage their cost threat direct exposure.

Furthermore, LRP is readily available for various livestock types, consisting of livestock, swine, and lamb, making it a versatile danger administration device for animals manufacturers across various sectors. Bagley Risk Management. By familiarizing themselves with the ins and outs of LRP, manufacturers can make enlightened choices to safeguard their investments and make certain financial security when faced with market unpredictabilities

Benefits of LRP Insurance Coverage for Livestock Producers

Animals manufacturers leveraging Animals Risk Protection (LRP) Insurance obtain a critical benefit in shielding their financial investments from rate volatility and protecting a stable economic footing amidst market unpredictabilities. By establishing a floor on the rate of their animals, producers can reduce the threat of significant economic losses in the event of market downturns.

Moreover, LRP Insurance provides producers with tranquility of mind. On the whole, the advantages of LRP Insurance policy for animals manufacturers are significant, offering an important tool for managing risk and ensuring financial security in an unpredictable market environment.

How LRP Insurance Mitigates Market Threats

Minimizing market risks, Livestock Danger Security (LRP) Insurance coverage offers livestock manufacturers with a reliable guard against rate volatility and monetary uncertainties. By offering protection against unexpected price decreases, LRP Insurance policy helps producers protect their investments and preserve financial stability despite market variations. This sort of insurance enables animals manufacturers to lock in a cost for their pets at the beginning of the plan duration, making certain a minimum rate degree no matter of market adjustments.

Steps to Secure Your Livestock Investment With LRP

In the realm of farming danger administration, applying Animals Threat Defense (LRP) Insurance policy involves a tactical process to protect investments against market fluctuations and unpredictabilities. To safeguard your animals financial investment properly with LRP, the initial action is to examine the particular dangers your operation deals with, such as price volatility or unexpected weather occasions. Comprehending these dangers enables you to identify the coverage degree required to safeguard your investment effectively. Next off, it is vital to research study and choose a credible insurance coverage supplier that provides LRP plans tailored to your livestock and organization requirements. Once you have actually selected a company, thoroughly review the plan terms, conditions, and insurance coverage limitations to ensure they straighten with your danger management objectives. Additionally, consistently checking market trends and changing your coverage as needed can help optimize your protection against potential losses. By adhering to these actions carefully, you can improve the safety and security of your animals financial investment and browse market uncertainties with confidence.

Long-Term Financial Security With LRP Insurance

Ensuring enduring financial stability via the usage of Animals Threat Security (LRP) Insurance policy is a sensible lasting strategy for agricultural producers. By incorporating LRP Insurance into their risk monitoring strategies, farmers can secure their animals investments against unpredicted market variations and unfavorable occasions that might jeopardize their financial health gradually.

One trick benefit of LRP Insurance coverage for long-term economic protection is the comfort it provides. With a trustworthy insurance plan in area, farmers can alleviate the monetary risks related to unpredictable market problems and unexpected losses as a result of aspects such as disease episodes or natural calamities - Bagley Risk Management. This security allows manufacturers to focus on the everyday operations of their animals company without continuous fret about potential economic problems

Moreover, LRP Insurance policy provides a structured technique to managing threat over the long-term. By establishing specific insurance coverage levels and choosing proper endorsement periods, farmers can customize their insurance prepares to straighten with their economic goals and take the chance of tolerance, making sure a sustainable and protected future for over at this website their animals procedures. Finally, investing in LRP Insurance is an aggressive strategy for agricultural manufacturers to achieve long-term financial protection and safeguard look at here now their source of incomes.

Verdict

To conclude, Livestock Danger Protection (LRP) Insurance coverage is a useful tool for livestock manufacturers to minimize market threats and secure their investments. By comprehending the resource advantages of LRP insurance policy and taking actions to implement it, producers can achieve long-term financial safety and security for their procedures. LRP insurance policy gives a safeguard against price fluctuations and ensures a degree of security in an unforeseeable market setting. It is a sensible selection for safeguarding livestock investments.

Report this page